Wednesday, December 30, 2015

The Year in Film ... All Roads Cross in Ex-Machina

I suppose it should be no surprise that given previous posts about film ... that two of the three actors that made the year 2015 would be Alicia Vikander and Oscar Isaac. The third would be the Irish actor Domnhall Gleeson. Given that he is the son of the great Brendan Gleeson, it might not come as a huge upset that he is an accomplished actor but given this list of films in the past year ...

Star Wars

The Revenant

Brooklyn

Ex Machina

he has a resume in one year that most actors would be thrilled to have in a career. Typically cast as a sweet if somewhat goofy young man (see About Time) he was unrecognizable as the stern young General Hux in Star Wars. It bodes well for his future success.

The three wonderful young actors were cast together in what might prove to be the film of the year, Ex Machina. They have the three speaking roles (basically) in the story of a young man asked to spend a week evaluating the artificially intelligent life form (Vikander) at the behest of a dark tech mogul (Isaac) in a remote complex shut off from the world. (Nod to Sonaya Mizuno whose unspeaking character plays a major role as well.)

Isaac brought us through Show Me a Hero and for the third year in a row has a film that closes the year and is considered a must see triumph:

Star Wars (2015)

A Most Violent Year (2014)

Inside Llewyn Davis (2013)

How many hearts swooned (among them several friends on Facebook apparently) at his portrayal of Poe in Star Wars? Any of us interested in politics, social justice and the challenges of urban America marveled at his work as the Mayor of Yonkers.

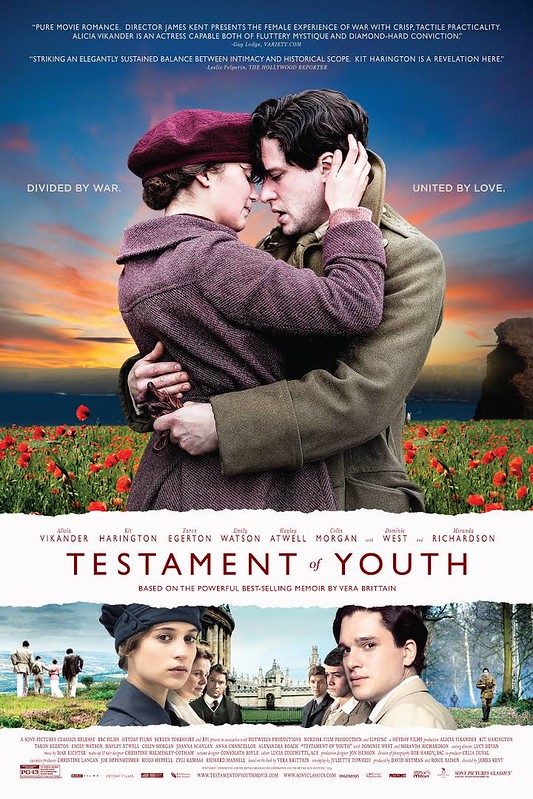

But 2015 was the year of Vikander. Something I tweeted about in the spring after watching her play Vera Brittain in Testament of Youth. Her year has been recognized in the press. Vogue and Vanity Fair among them. In US theaters this year ...

Testament of Youth

Man from UNCLE

Ex Machina

The Danish Girl

... plus smaller roles in lesser films. She has been nominated for two Golden Globes (Danish Girl and Ex Machina) which is remarkable because Testament (which was released in the UK in 2014) was a revelation. Somewhat ironically, there is an upcoming documentary about Ingrid Bergman which should bring forward some comparisons. I believe that we will see an amazing career unfold (perhaps the strongest by a woman since Streep?). Vikander brings an energy and character that belies her slight frame and easy beauty. Both Danish Girl and Testament open with long shots of her face. Smart, pained and lovely ... an elegance she can not shake. A future that is promising and broad and deep.

Thursday, December 17, 2015

What the FED also did this week

Other observers, such as Harold Meyerson in the Washington Post and Dean Baker of the CEPR have commented on the political and economic downside of the steps toward higher rates given the changes in US political economy that make one doubt that wage based inflation was anywhere ahead. Typically the Fed will bring the rates up based on concerns about price levels once the economy approaches full employment. The concern with the headline action is that we do not have that strong of a labor market and price inflation is historically low. For example, there is weak demand for commodities across the board keeping prices in check. Wages have seen tepid increases at best.

But hidden in the Fed's message (because the press never writes about this) is another action taken by the Fed to raise a key interest rate ... the interest paid on required and excess reserves. Banks are required to keep money on deposit to the Fed equal to about 10% of their deposits. That is money they are not allowed to lend or invest in another manner. It has to be there to take care of customer demand for their money. If banks get caught short they can temporarily borrow to get back in balance. But starting during the economic crises banks started to accumulate gigantic amounts of excess reserves and a change in law allowed the Fed to start paying interest on those reserves.

Today the amount of excess reserves stands at about $2.4 Trillion (yes with a T). This is a result of the Fed buying securities from the banks as part of its extraordinary measures to fight the crisis. Some of that are capital inflows into the US from foreign depositors as a result of the Euro crisis and instability in global equities and bonds (even negative rates some places). People like parking money in the US even though the return has been low. It is safe.

Since the Fed pays interest on these monies it is also a profit making center for the commercial banks that own these excess reserves. This week the Fed increased that rate to keep pace with the Fed Funds rate. At current levels this means an additional $5 to $6 billion per year in revenues to the banks. Money that might otherwise be returned to the taxpayers. Outside of being friendly to bankers (which sadly the Fed does too often) the technical reason is so that the mountain of reserves doesn't flow speedily into the real economy and spark inflation by a build up of money. The obvious question becomes is this going to continue as further interest rate increases occur? Is this their plan to wind down the positions in cash taken by the banks?

It is ironic that as they take actions to weaken worker wages and employment they take more actions to help banks.

Tuesday, October 20, 2015

Canadian Election 2015

Monday, September 7, 2015

Labor Day Thoughts

Harold Meyerson for A Happy Labor Day

David Cay Johnston on why American Workers Deserve Better

The New York Times on Wages and Interest Rates

The President takes action on Paid Sick Leave while in Boston

John Lippitt on Investment in Human Capital

Friday, September 4, 2015

Show Me a Hero

Sunday, July 5, 2015

Greece and Democracy

As James Galbraith writes in The American Prospect and elsewhere ... The challenge in Europe is the narrowness of vision of the European elite. Centered in the governments of the core and bureaucracy of Brussels, these narrow minded leaders, not worthy of the word, have forced the continent into deflation and depression and threatened the whole European project. Achieving nothing but broader smiles in the face of David Cameron and the like who are bound and determined to blowup the entire structure.

All countries knew when they joined the EU they were sacrificing some sovereignty. The hope was the trade off resulted in more peace and more prosperity. And so it did as long as the bubble of trade deficits/debt/housing continued. When that popped the house of cards came tumbling down and with it the vision of Calvanistic punishment for incorrectly perceived profligacy. In the case of Greece, the price of relief from the commercial bankers was a regime imposed by The Troika. Today's vote is a chance for the Greek public to say No!

Yet their democratic choice has been complicated by the interference from the core. It is sadly funny to hear German politicians lecturing the Greeks about responsibility. The bottom line is that Greece should be free to make its choice and move ahead with its direction even if that means leaving the Euro Zone. Greece couldn't join Europe until it through off the shackles of dictatorship and moved to democracy. Why should Europe be demanding a step back when it benefitted from the policies that brought Greece to this point? Obviously leaders like Germany's Merkel are worried about the precedent of Syria in Greece leading to other anti-austerity tendencies like Podemos in Spain (who have elected Mayors in Madrid and Barcelona), the SNP in Scotland and the exciting emergence of Jeremy Corbyn as a candidate for Labour Party leadership in the UK. So they are saying let's rupture democratic processes so we can hang onto our jobs, continue the disastrous conventional wisdom and teach a harsh lesson in moral hazard.

Greece please, Just Vote No. #oxi

Wednesday, July 1, 2015

Good news from President Obama ... OT Edition

With the unemployment rate falling but the workforce participation rate and median wages still stagnant, the long steady recovery from the crisis of 2007 to 2009 has only begun to reach into the homes of working families. With the refusal of Congress to take aggressive action to promote job creation it falls to the President to use his executive authority to move forward a family friendly economic policy. Oddly enough the President pushed hard for fast-track approval to further the trade agenda with the pacific rim. Actions that will lessen the wages and employment prospects of American workers.

Important economic actions are outstanding ... the surface transportation bill has survived on short term renewals; the reauthorization of the Export-Import Bank languishes and we are about to go through another budget drama ... all of which contributes to economic instability at a time when the economy needs help to boost the fortunes of workers. The aggressive actions of the President will pay off with higher approval ratings. And with that perhaps he can drag Congress along in the right direction.

Monday, June 29, 2015

Greece, Democracy and the Way Forward

Prominent voices in the US and Europe have called for the people to vote "No". Some like Paul Krugman have warned for years that a single currency zone absent political integration would end in disaster. Joseph Stiglitz also counsels on his approach to the conflict and his rationale for the vote against the next wave of austerity. Two weeks ago Amartya Sen called on the EU to end its austerity regime aimed at Greece saying that the Keynesian formula of spending in the face of contraction (Greek GDP is down 25% since the crisis began four years ago) is the right one and austerity counterproductive. If three Noble Prize winning economists are saying the approach of the Troika are wrong ... who supports their destructive ideas?

As the great summary of the crisis from Social Europe shows, the point of the bailout of the government and the continued assistance to the Greek banks was to help the holders of Greek sovereign debt ... banks in Germany, France and the rest of Europe. Now the Troika largely owns the debt. So what the Troika wants Greece to do is contract the income of their people more in order to generate trade and government surpluses to provide funds to pay off the creditors. The fact of the matter is many of these institutions made poor business decisions and now the Greek people are asked to pay the bill. The Troika wants the Greek government to continue to commit Macro malpractice after a generation of Germany (and other export driven economies) allowing Greece to import significantly more than it exported in order to enrich Germany (and other export driven economies) which expanded the nation's indebtedness.

Today Greece has eliminated its current account deficit and so is near to running primary government surpluses. However, this level is not enough to repay the creditors. So what is to be done? The answer is to leave the Euro with all the risk and confusion that will entail. With its own currency Greece can devalue its debts. It is the path that allows Greece to control its future and have some hope of generating economic growth and prosperity. The question becomes to what lengths will Germany, and the other European powers-that-be, go to prevent Greece from charting its own future and self revaluing its debt?

Sunday, June 21, 2015

Testament of Youth (2014)

One hundred years ago the world was in the engulfed in the first of the three great European wars of the 20th Century. Starting in 1914 the First World War reached out of Europe to include Africa and North America in its insane grip. Millions died in the war and its indirect misery and the stage was set for the second and third (Cold) wars where the impact grew across the globe. In the U.S. The milestones seem to flow by with little note. The sad anniversary of the sinking of the ocean liner Lusitania was in May. Perhaps a wreath bobs on the ocean left by someone connected to the event.

Thankfully the British have taken one modest step to remind us of the origins and impacts of the war to end all war. Last fall a new feature length film version of the heart wrenching memoir, Testament of Youth was released theatrically in the UK. This weekend it finally made it to Boston. For those of us familiar with the work by the pacifist campaigner, Vera Brittain, the opening scenes of the idyll of the British countryside and the young people engaged in their last flirtation before the war fills one with dread. The film, as the book, pulls no punches in its depiction of the hubris of the British public thinking the war will be brief and impact less.

When I read that the filmmakers were redoing the story and eventually recast the lead to be Alicia Vikander I was a bit concerned. Could a young actress from Sweden capture the proper spirit of the strong headed woman who would make such a mark on generations to come? The 1933 book took on a renewed life in the late 1970's through an epic telling on the BBC with Cheryl Campbell as the lead. In the new film Vikander shows the talent that promises to make her a giant in international film. Given a spare script, she leaves no doubt on her angelic face of the range of emotions that young Vera experiences and she goes from rebellion to love to loss and then rebellion again.

She is paired with the equally beautiful Kit Harrington as her fiancé Roland Leighton. He, like her brother and their cohort of friends and school mates, march off to war with the care free bravado seen in other films of the era, Doctor Zhivago or Nicholas and Alexandra come to mind. They return in a way that killed that innocent Edwardian idyll and has left the world with a set of problems we have not transcended across the century. Vera loses all she cherishes on earth during the war but gains a self which the film allows us to glimpse. The text crawl at the end could not possibly do justice to the importance she had as a writer and graduate of Oxford who dedicated herself to trying to make the world a more peaceful place.

The story has haunted me for nearly forty years. Hopefully one hundreds years from now someone will write about how we have better learned the lessons she was trying to teach us. Not romance but practically that these foolish wars, which we still insist on fighting, makes us less safe and secure. And that their prosecution changes us and not for the better.

Friday, May 8, 2015

UK Election - Quick Thoughts

This time the protest vote went to the SNP in Scotland and the UK Independence Party in England. Ironically, UKIP which picked up hundreds of thousands of votes over 2010 and finished at 13% - got one seat in Parliament. The SNP which runs candidates only in Scotland, swept every district except three and won an additional 50 seats over 2010.

In a manner typical for British politics after a hard fought contest … heads are rolling as the leaders of Labour, LibDems and UKIP all resigned their posts. More on the travails of Labour and challenges for the next government soon.

Wednesday, February 11, 2015

The BIS Paper on Borrowing and Leverage in OIl

Saturday, February 7, 2015

Not the Time to Raise Interest Rates

Despite this weakness there is discussion of having the Federal Reserve start to raise interest rates from the zero lower bound and the justification is the normal nonsense about preventing inflation (which is non-existent). But there are other economic headwinds that will be made only worse if US interest rates rise. In the last few months the US Dollar has strengthened against most foreign currencies. Against the Euro alone there has been a shift of about 20% in the favor of the dollar. This trend has deepened because of monetary policies taken abroad which have lowered interest rates or injected liquidity in Europe, Asia and Latin America. The US Dollar has gone from near parity to a 25% premium over the Canadian Dollar during this period.

Not surprisingly, we have already seen the inevitable result of this movement. Growing trade deficits. The US runs persistent current account deficits and if the dollar does not drop in value against foreign currencies those deficits will continue and under current trends … deepen. Having the Federal Reserve raise rates will only make this problem worse. When the currency strengthens against others it worsens our trade position (it makes foreign goods and services less expensive relative to our own) depressing exports and increasing imports. A widening traded deficit means that more income from the US is shifting overseas making it less likely that we will achieve the recovery we need from the crisis of 2007-2009. The Federal reserve should postpone any action that will cause the rebound in private sector employment to abate.

Thursday, January 29, 2015

Ratner and Europe

Apparently the NY Times feels the need to give equal time on their oped page to disgraced investment bankers but I am not sure why we should read the pieces. Today, Ratner is trying the make the case that it is a bad thing if wages rise in Europe. While Dean Baker does a nice take down of his argument I think it points to a deeper issue which is that somehow what is good for workers is bad for business. It is a fundamental rule in economics that one person's expense is another person's income. After all, where is the business supposed to come from? I suppose if our cause for concern is the fortunes of makers of 50 foot yachts you might make the argument that paying skilled blue collar workers better is not going to help sales.

It is not clear from his graphics what his baselines are for "output" and what currency he is measuring. My guess this is just another screed on behalf of oppressed rich investment bankers everywhere.

Tuesday, January 27, 2015

Greece and a Moment for Hope

But there are those that would stand in the way. The Troika (EU, IMF and ECB) lead by voices from Germany rail against the demands for lessening of the mutual economic destruction pact that is represented by arbitrary deficit goals. In the case of Greece and other countries, the assistance from the Troika to stave off default on sovereign debt came with crippling restrictions. The result has been internal devaluation (severely lower incomes), high unemployment and mass misery. The parties of bigotry, such as the National Front in France or Golden Dawn in Greece or UKIP in the UK, have an appeal that capitalizes on the anxiety of people suffering at the whim of the distant (seemingly anyway) powers.

The parties of the left that have tried to make their peace with austerity have suffered at the polls. Some have suffered division or worse (Pasok the former governing party of the left in Greece is a shadow of its former self). Can the other parties looking at a general election such the Socialists in France or the Labour Party in the UK learn a quick lesson from Syriza and support their cry for a people oriented solution to stagnation and speculation? The next steps by these parties may tell the tale of their fate in elections soon to come.

Thursday, January 22, 2015

Deflation and the current economy, Part II - The Swiss Case

Today the other shoe dropped in that the European Central Bank announced its formal program for extraordinary measures to combat economic stagnation and the spectra of deflation. The size of the program, 60 Billion Euro per month for at least 18 months, should certainly impress the markets. Whether they will accomplish the goal, is another question. Again the central bankers are trying to inflate the economy to push back on levels of unemployment that are deemed to be too high. However, because they and so many "very smart people" are pushing further into an age of austerity the normal lever of fiscal policy is not being used in Europe.

While fiscal policy in the US is nothing to write home about it has been used a bit, whereas in Europe the concern over sovereign debt has lead governments to cut back worker pay and therefore standards of living. This contributes to the deflationary pressure in Europe which is spreading to other parts of the world. In part the Euro common currency is to blame. Since 19 European countries are part of a single currency, those that need a devaluation like Greece or Spain, could not get it because their partners included Germany which wanted to keep the currency stronger. The currency devaluation makes the countries (or zones) products less expensive and is designed to help balance trade through higher exports and lower imports. For countries that needed a rebalancing they were forced to internally devalue through lower wages, lower social benefits and higher taxes. Theoretically, this gets them to the same place but it requires sacrifices by specific members of society rather than the across the board cuts if a currency was revalued.

The shoe that dropped last week was Switzerland. The Swiss (not part of the EU or the Euro Zone) years ago pegged their currency to the Euro in order to maintain a stable exchange rate. The method of maintaining the peg involved going into the currency markets to purchase Euros and supplying Swiss Francs in order to bolster the value of the Euro, versus the Franc. This action resulted in that more or less stable rate that the Swiss banking authorities wanted but ballooned the balance sheet of the Swiss central bank as they accumulated more and more foreign currency. Last week, in the face of the effective devaluation of the Euro (QE and lower interest rates will decrease the value of the Euro versus other currencies) the Swiss gave up on the peg and let the currency rise to a market level. The change was a drop of over 20% (see the cliff graphic above).

The pressure for the rise in value of the Franc comes from the fact that Switzerland has been running persistent trade surpluses with the rest of the world for many years. Economic theory tells us that under this circumstance the country's currency should rise and that will make their products more expensive and exports will fall and imports rise (they can buy more from overseas) and the balance will be reestablished. This is great for economists but not so great for politicians as they have a hard time explaining to people their recessionary activities to create balanced international trade. But the Swiss are not going to get away free here as they were already facing deflationary pressure (their CPI peaked in 2010 and has been declining since) and the strengthened currency will only make it worse.

Switzerland has a very low unemployment rate at 3.4% but they have seen a small upswing since the summer when it was at 2.9%. The currency float should force some higher levels of unemployment in the near term. Why didn't they continue their peg? Too much foreign currency. Why didn't they just use the currency for something like a sovereign investment fund? They are Swiss after all and don't like entanglements in other countries.

We will see bad things happen to companies with Swiss HQ and operations abroad. The currency will make foreign profits disappear. The deflation (that everyone is facing) will put pressure on profits and prices everywhere. More unemployment will result from the contracting economies. All because Europe refuses to take the more direct path to recovery … reverse austerity. End a very bad idea.

Wednesday, January 21, 2015

Deflation and the current economy, Part I

Since the technical great recession ended in 2009 the thrust of central bank action in the US has been to try to get around the monetary policy restrictions of the zero lower bound by trying extraordinary action called Quantitative Easing (QE). This involved purchases of government bonds and mortgage backed securities, a process that ended last year. The hope is that the increased purchases would help lower longer term interest rates and spark investment in depressed areas of the economy (housing) and business expansion. Its effectiveness is still under debate.

Other parts of the world basically rejected that approach. Until now. The European Central Bank is working this week on a plan to engage in its own form of QE. But as always they are cowed from doing the important things correctly because of pressure from Germany. Why the concern? Deflation. Yes, a spectre is haunting Europe (and the rest of the world). Deflation. As we see from the above chart of the US we have been seeing disinflation here … lower and lower rates of inflation. We are on the path to deflation too.

Why the deflation? Because of the premature rush to austerity that the world engaged in since 2009 economies have absorbed that by lowering public expenditures, lowering incomes and lowering prices. So the problem with deflation is that it means lower incomes too. This is what has plagued Japan (much of the period since 1990 has seen low rates of inflation or outright deflation), Europe and perhaps soon the US and China.

This problem intensified The Great Depression. It is now wrecking the living standards of Europe particularly in those countries suffering from internal devaluation. Remember that the same people that thought that inflation was a solved problem came up with this cure that is looking worse than the problem. What can we do about this?

Wednesday, January 14, 2015

Rank hypocrisy on the Paris march

Dana Milbank of the Post did an excellent job documenting some of the hypocrisy in the criticism not the least being the denigration of all things French while their government opposed the War in Iraq or the fact that John Kerry is fluent in French and spoke to the French people in their tongue after the horrible attack.

However, there is an even bigger flaw in their logic. When terrorist killed over 200 in Madrid in 2004 and then millions marched in Spain the Bush Administration did not send any high ranking officials to the affair. Rather the President and First Lady signed a condolence book at the Spanish Embassy much as did President Obama. Did Republicans denounce the Administration for not showing more support for an ally in an unpopular war? Not a word.

That is until the 2008 Republican Presidential candidate wouldn't commit to inviting the Spanish Prime Minister to the White House. Again, it is all about political posturing, and amounts to rank hypocrisy.

Friday, January 9, 2015

Employment Not Near Full

On many fronts the news from the Bureau of Labor Statistics was good today. The December 2013 unemployment rate was down and firm hiring was up. Revisions from previous months continue the good news of higher levels of hiring.

"The change in total nonfarm payroll employment for October was revised from +243,000 to +261,000, and the change for November was revised from +321,000 to +353,000. With these revisions, employment gains in October and November were 50,000 higher than previously reported."

As other observers comment, there are other signs of the continuing slack in the labor market. Dean Baker of CEPR comments that while the unemployment rate has decreased over the last few months from 5.8% to 5.6% that wage rates continue to stagnate. A major issue is the still declining employment to population ratio.

Jared Bernstein points out that employment growth accelerated over the course of 2014. Why? He makes the case that the decline in fiscal drag ... the turn to fiscal neutrality (no tax increases or spending cuts from the big ones of 2013) ... means that the tepid economic recovery actually created jobs.

Given these comments and other aspects of context, low inflation in the US, low growth and deflation in Europe and apparently China, why would the Federal Reserve still float the possibility of raising interest rates? The interest rate increase would act the same as the fiscal drag from spending cuts. In the absence of any inflation, why? The actions would wind up dis-employing those people who just got jobs. This recovery has been painful and slow and the Fed should take actions to improve employment, not discourage it.

Keep rates low. Encourage Congress to invest in our country.

Tuesday, January 6, 2015

ASSA 2015 and the intellectual fight against inequality

In the panel under discussion, John Schmitt (The Center for Economic Policy Research), David Cooper (Economic Policy Institute) and Robert Pollin (University of Massachusetts) all presented research and analysis about the impact of the minimum wage on employment. The discussants were researchers in the field and represented the "mainstream" views on the issue. It breaks two ways ... those that see a measurable effect on employment (negative) and those that see a small amount of impact or insignificant impact.

Schmitt, Cooper and Pollin all have excellent approaches to the examination of the impact of the minimum wage. Cooper shows how an increase reduces the reliance on reliance on social safety net programs. Schmitt explores the conflicting literature in employment impact to conclude that the unemployment impact is negligible. Pollin and his colleague explored how food service companies could absorb a $15 minimum wage over time with minimum impact on employment. As is always the case with academic discussions much of the time is spent debating methodologies with the discussants and panelists tossing phrases back and forth that loses all but the most knowledgable researchers (two stage fixed effects model anyone?).

The most interesting point I found was the political and policy nature of the papers and discussions. These weren't exercises in refining abstract models of economic behavior but rather a debate on the real world impact of public policy that has a foot in the economic realm. Why only a foot? The unaddressed issue is why we have a minimum wage anyway and what does that tell us about microeconomic theory.

As I write elsewhere, in liberal democracies we depend on the market to allocate most economic resources and we reallocate those resources when we find a failure of the market. By market failure we mean that resources are not distributed in a fashion that society views as appropriate. Pollution transfers costs from a producer to the general public allowing the producer to capture profits above what is justified based on value. Another example is a monopoly which transfers consumer surplus to producers. In labor markets firms are the consumers of labor, they hire people to do specific jobs. But sometimes they hire people at wages which society deems as to low to maintain a minimum standard of living. It is a market failure. We offer a social safety net to compensate but starting in the Great Depression we pegged a specific wage from which employers must only move up. A minimum wage.

The question remains as to why conservative economists and policy makers are concerned about the potential employment effects of the minimum wage? In this model we have decided that the minimum wage makes up for a flaw in the market. Meaning that if the justifiable wage for a specific job is below the minimum, society is making the determination that the work is not worth doing. Why would they object to society adjusting their peg over time to account for changes in assumptions about a minimally acceptable return on work? It seems as too often the case is that the judgement on policy prioritizes politics over philosophy/morality or even microeconomic theory.

As the theoretical and practical policy work continues on the problem of inequality, we can't forget the other basis for judging policy, does it get us to the society we want? The minimum wage has become a critical element in the political fight over actions to reduce economic inequality. We need to discuss other actions which would help the economy and help us achieve this critical policy goal.